5 Keys to Successful Awareness Market Research Studies

November 21st, 2020

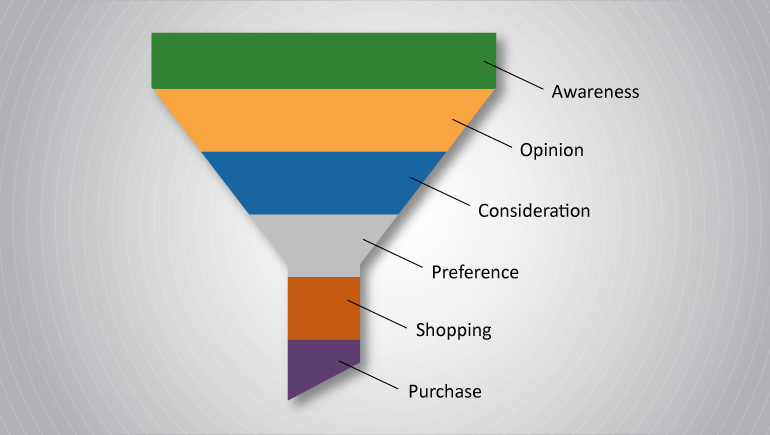

We at TRC conduct a lot of choice-based research, with the goal of aligning our studies with real-world decision-making. Lately, though, I’ve been involved in a number of projects in which the primary objective is not to determine choice, but rather awareness. Awareness is the first – and arguably the most critical – part of the purchase funnel. After all, you can’t very well buy or use something if you don’t know it exists. So getting the word out about your brand, a new product or a product enhancement matters.

Awareness research presents several challenges that aren’t necessarily faced in other types of research. Here’s a list of a few items to keep in mind as you embark on an awareness study:

Don’t tip your hand

If you’re measuring awareness of your brand, your ad campaign or one of your products, do not announce at the start of the survey that your company is the sponsor. Otherwise you’ve influenced the very thing you’re trying to measure. You may be required to reveal your identity (if you’re using customer emails to recruit, for example), but you can let participants know up front that you’ll reveal the sponsor at the conclusion of the survey. And do so.

The more surveys the better

Much of awareness research focuses on measuring what happens before and after a specific event or series of events. The most prevalent use of this technique is in ad campaign research. A critical decision factor is how many surveys you should do in each phase. And the answer is, as many as you can afford. The goal is to minimize the margin of error around the results: if your pre-campaign awareness score is 45% and your post-campaign score is 52%, is that a real difference? You can be reasonably assured that it is if you surveyed 500 in each wave, but not if you only surveyed 100. The more participants you survey, the more secure you’ll be that the results are based on real market shifts.

Match your samples

Regardless of how many surveys you do each wave, it’s important that the samples are matched. By that we mean that the make-up of the participants should be as consistent with each other as possible each time you measure. Once again, we want to make certain that results are “real” and aren’t due to methodological choices. You can do this ahead of time by setting quotas, after the fact through weighting, or both. Of course, you can’t control for every single variable. At the very least, you want the key demographics to align.

Timing matters

In the pre/post ad campaign scenario, you want to get your pre-wave in before the research participants are at risk of exposure to the campaign. Sometimes the research department isn’t brought in until the campaign is about to launch… which makes fielding a pre-wave difficult. Stay on top of campaign launch schedules, and give yourself plenty of time to design and field the pre-wave.

Be mindful of change

Long-term awareness tracking studies are expensive and sometimes the results can be, well, boring. A savvy researcher will use the trackers to insert hot-topic questions that can be rotated in and out over time. But beware: you don’t want the placement of those questions to have any bearing on the trending results. Make sure they come after all of the key measures have been completed. Likewise, changes in method can have unintended consequences. We take all changes to our tracking surveys very seriously. Sometimes we run waves in parallel (one with a key change, one without it) to bridge the gap. (And of course, we match the samples.)

This is just a short list; there are other factors to consider, such as how to use test and control samples, how to order the topics in the questionnaire and so on. But hopefully this will get your next awareness study off on the right foot.